Equity – Money Boxes ← Back to the projects PAGE

- In →

- accessories

Do you want to invest in property, but can’t afford it?

Equity moneyboxes are a set of four vessels in which to store and save your hard earned dollars. While there are many different strategies that you can employ to make money, there is really only two ways to see it grow: the first is from hard work and direct saving, the second from investment/capital growth.

Equity moneyboxes are designed to assist the user in the practice and simulation in both these areas. The first puts money directly in your pocket and the second way of making money relies on properties increasing in value.

Is it time to buy?

Knowing when to begin a property portfolio is often harder than knowing how to begin a property portfolio.

Entering the property market is typically done in one of two ways – either by saving for a deposit and buying your first home, or by leveraging the equity from an existing property as a deposit. This requires some or all of the original loan to have been paid off and/or the property to have increased in value.

So, how does it work?

Step 1. Start by investing in a small affordable home (1), keep this house for a period, investing in it regularly, over time the house will increase in value (by the additional amount you’ve deposited into it), this increase in value is all yours – and as such, you’re making a profit.

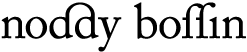

Step 2. If you hold property for the long term, you can see significant increases in the houses equity value (the difference between what your home was originally worth and how much you’ve put in it). It is now time to use the equity from the first house to invest in a bigger house (2), this will afford a larger capacity to continue to invest and save.

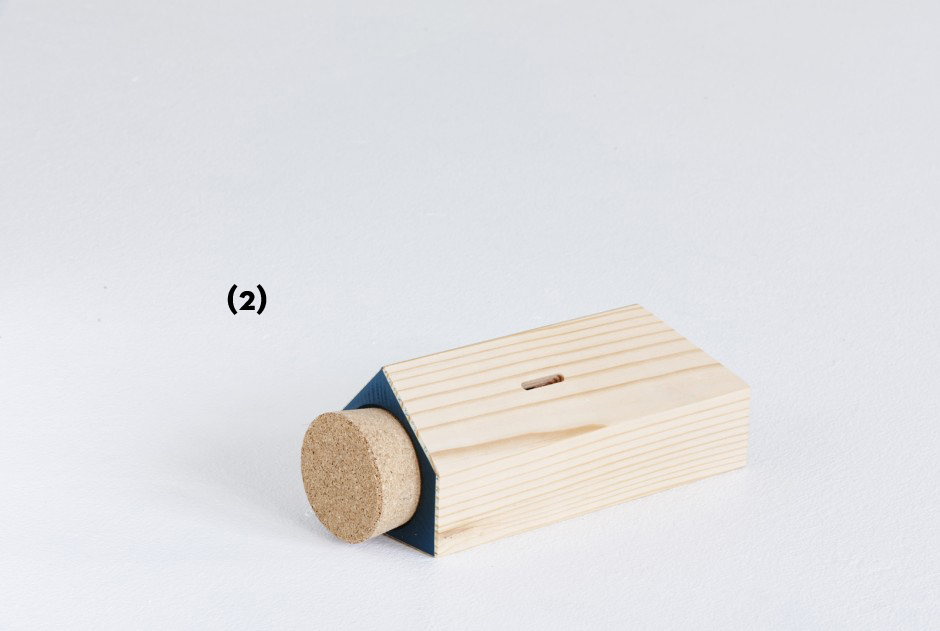

Step 3. You now own two properties, one small and one big, with these two properties you can earn (save) a great deal more than you could before and as time passes your properties increase in value. Once again your equity has grown enough for you to consider loaning money from assets, to reinvest in an extension (3) to your current home, which will of course add value and give a capacity for more money to be made and retained.

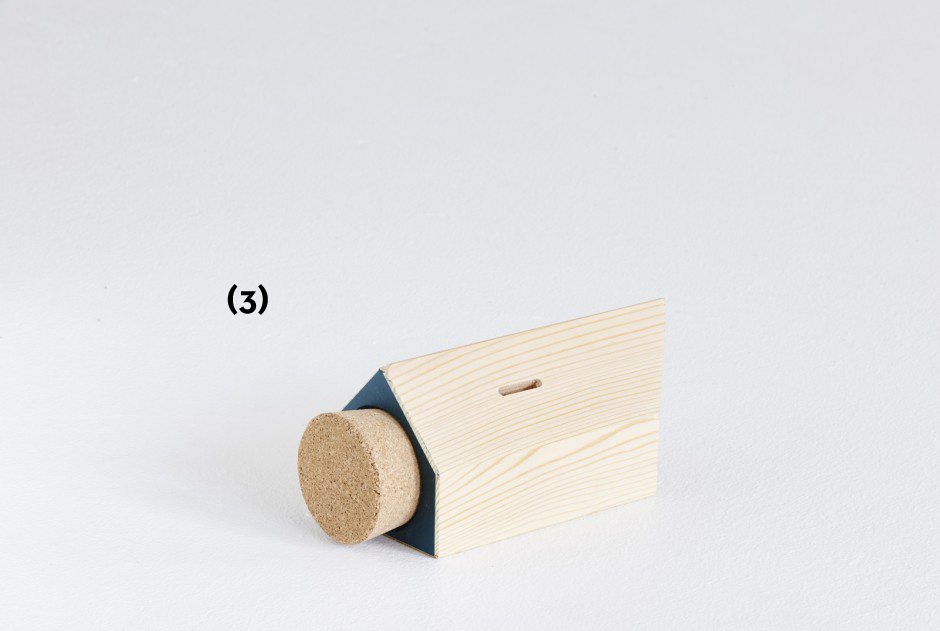

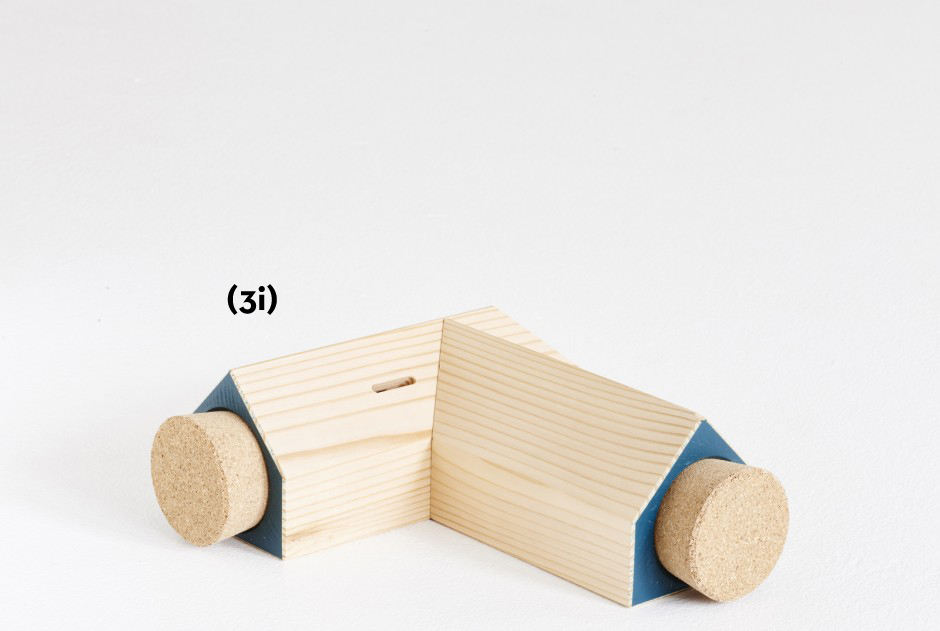

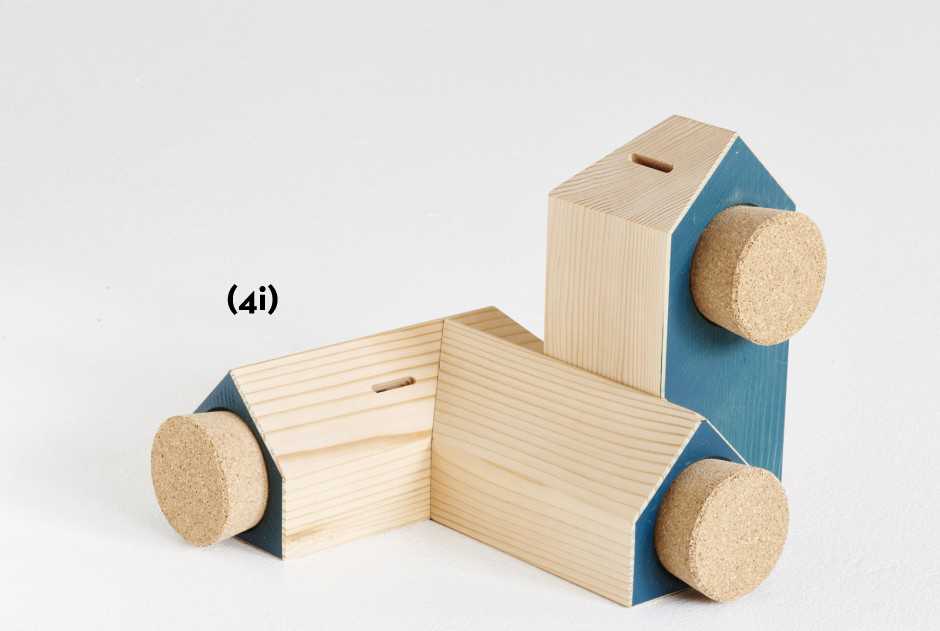

Step 4. You keep the small house and the large house with extension (3i) and over time with regular payments (interest free in this case) your properties further increase in value. You’ve now developed a sentimental attachment to your home and even though you’ve run out room, you can’t bare to part with it, so where else to go but up (4). You take the equity earned over time and reinvest in a second story (4i), which affords you’re investments the ability to continue gaining value.

Eligibility criteria:

- Have a regular income (pocket money counts)

- Have a good credit rating

- Be at least 2 years of age and older

- Currently residing in Australia (until we start to trading internationally)

Equity Money Boxes are a fun product that offers an endearing way to practice property investment, with no real financial risks. The set of four can be purchased as a complete set (5) or ideally collected over time, to truly experience the property investment experience.